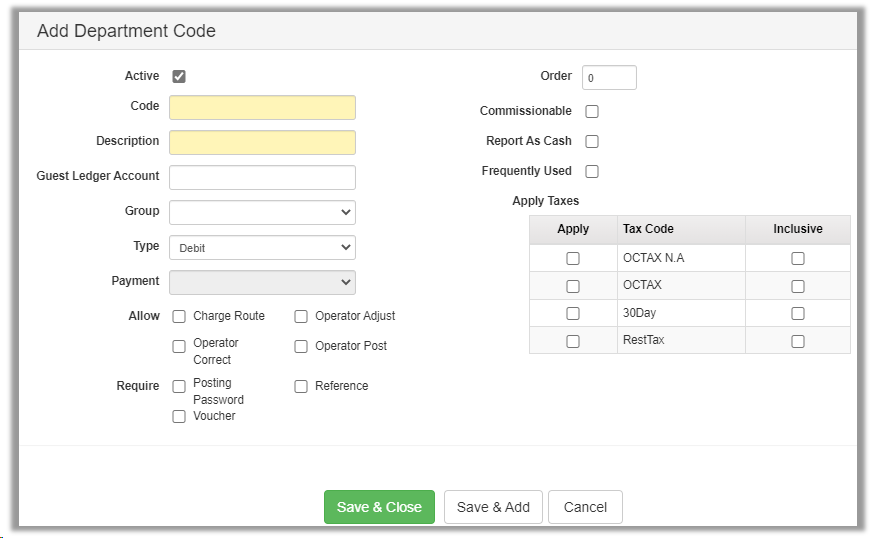

Department Codes

This is the section where you will setup all the account numbers your system will use to post with.

Video Tutorial

For a video tutorial please view: Department Codes

Administration > Accounting > Department Codes

To add a new code, click Add at the top. To change an existing account, click the Edit column on the far right.

| Field | Description |

|---|---|

| Active | Will be Active by default. Uncheck to deactivate the account. |

| Code | Enter the (short) Department Code for this account. |

| Description | Enter the long description for this account. |

| Guest Ledger Account | Reference cell when using some 3rd party accounting software. |

| Group | Select the Accounting Group this code belongs to. |

| Type | Select either Debit (charges) or Credit (payments). |

| Payment (only for Payment Type from above) | Select Credit Card, Direct Bill or Other |

| Allow | Choose the options which this code will have the ability to perform. |

| Charge Route | Route the code between folios. |

| Operator Adjust | User can use the Adjust option on the code. |

| Operator Correct | User can use the Void option on the code. |

| Operator Post | User is able to manually post to this code. |

| Require | Select which options will be required to post to this code. |

| Posting Password | User must enter their Chorum username/password to post to the account. |

| Reference | The user is required to enter information into the Reference cell when posting to the account. |

| Voucher | The user is required to enter information into the Voucher cell when posting to the account. |

| Order | Sets the order in which the Accounting Codes will sort by default. |

| Commissionable | Check if the account is used to calculate Commissions due. |

| Report As Cash | Check if the account is to be considered Cash for Shift Close purposes. |

| Frequently Used | Creates a Frequently Used Group at the top of the Post Charge/Adjustment windows. |

| Apply Taxes | Choose which taxes apply to the account (Debit accounts only). |